To Reduce the Federal Funds Rate the Fed Can

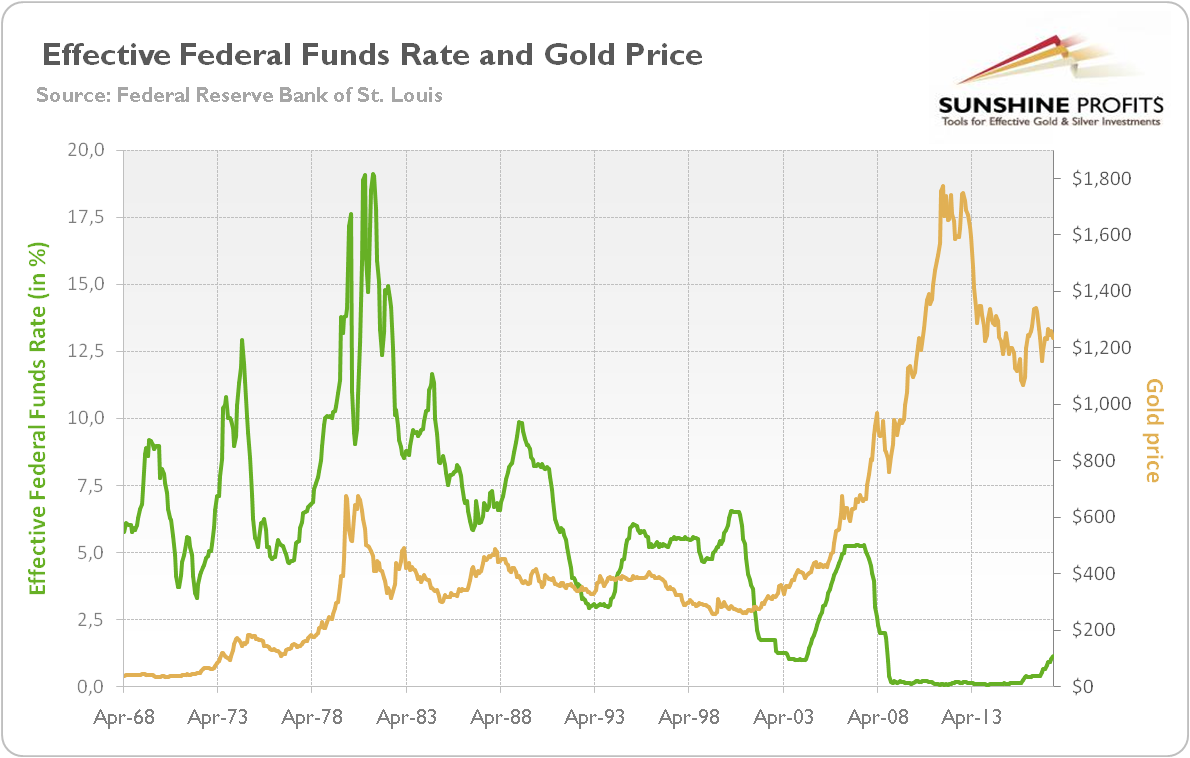

Rising inflation during the. Understanding the Funds Rate.

Why The Fed Lowered Interest Rates Again The New York Times

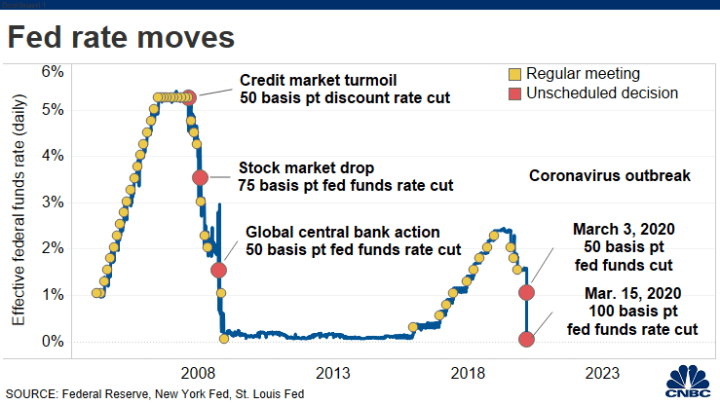

Mester wants the federal funds rate to increase to about 25 by the end of the year the level she sees as neither braking nor boosting the economy and which would require some 50-basis-point.

. The goal is to reduce the cost of borrowing so that people and companies are more willing to invest and spend. Objectives of the Supervision and Regulation function include protecting depositors funds. It is currently 0 to 25.

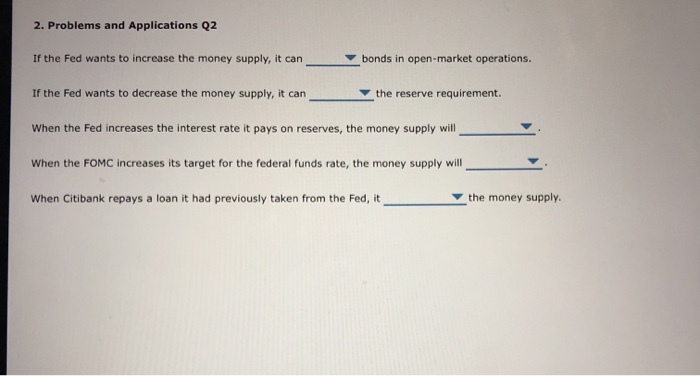

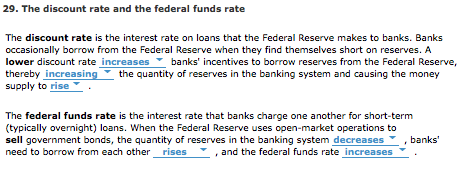

It also reduces business expansion investment and hiring. Banks use this rate as a starting point to set the prime rate for consumers. As previously stated this rate influences the effective federal funds rate through open market operations or by buying and selling of government bonds government debt2 More specifically the Federal Reserve decreases liquidity by selling government bonds thereby raising the federal funds rate because banks have less liquidity to trade with other banks.

Moreover this approach recognizes that because money is fungible even if Fiscal Recovery Funds are not explicitly or directly used to cover the costs of changes that reduce net tax revenue those funds may be used in a manner inconsistent with the statute by indirectly being used to substitute for the States or territorys funds that would otherwise have been needed to. Interest rate changes spill over to many facets of the economy including mortgage. And maintaining a stable efficient and competitive banking system.

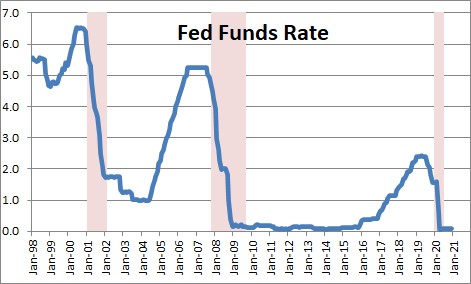

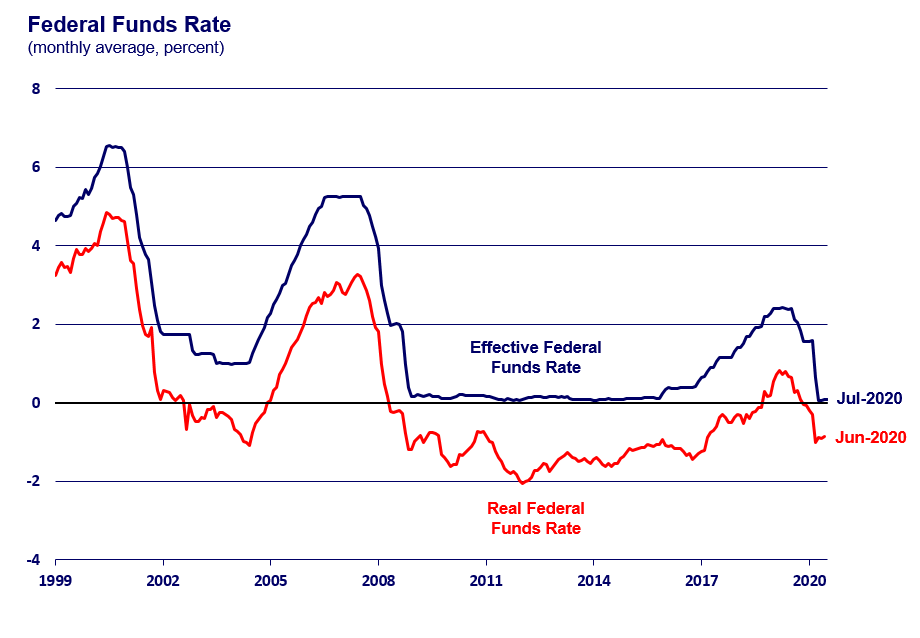

The Federal Reserve wrapped up its net asset purchasing program in early March 2022 as the Fed looks to. You can see how the average online savings account rate tracked the federal funds rate in our Online Savings Account Index chart. In contrast if inflation is running persistently too low the FOMC might reduce the target for the federal funds rate in an effort to bring inflation back up.

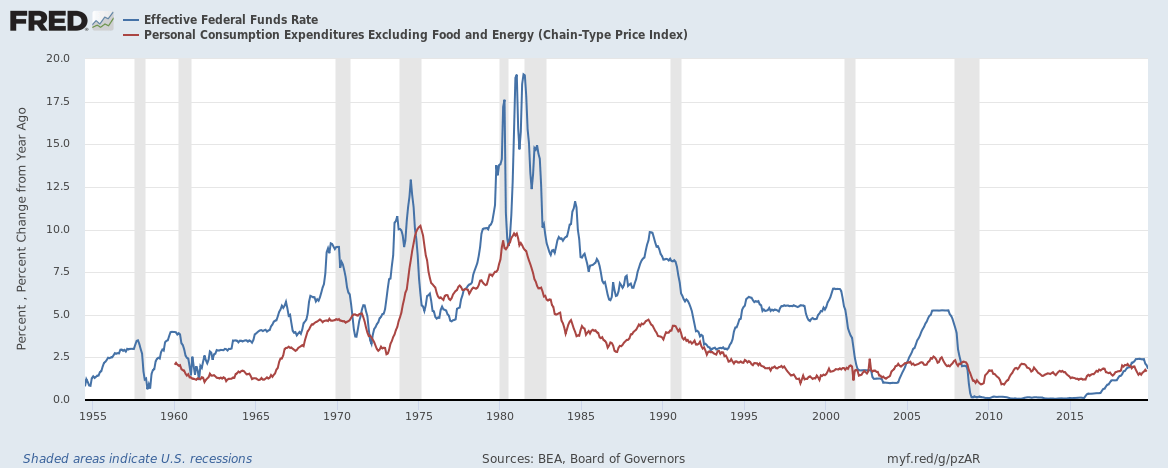

How the Feds 2 Percent Inflation Target Came to Be. The Federal Reserves net asset purchases ended in early March. A higher fed funds rate means more expensive borrowing costs and that can depress demand among.

That reduces the amount of money that banks have to lend. The Federal Funds Rate target range will increase by 25 basis points to 025 - 050. Up next is a plan to shrink the Feds balance sheet by limiting reinvestment into maturing securities.

The federal funds rate is the rate banks charge each other for short-term loans. The closest it tracked was during the first. In the December Summary of Economic Projections SEP released by the FOMC the consensus expectation was that the federal funds rate would increase to 075 in 2022 due to the rise in inflationThe Fed had consistently said it would signal liftoff in advance of an increase and todays statement.

That slows consumer borrowing and demand. Thats called contractionary monetary policy It is beneficial to know when the Fed will raise rates. As such the FOMC adopted an explicit inflation.

Perhaps less clear is whether a change to this interest rate known as the federal funds rate impacts you on. As mentioned earlier the FOMC interprets an inflation rate of 2 percent as consistent with price stability. To reduce inflation the Fed raises the fed funds rate.

The federal funds rate impacts how much commercial banks charge each other for short-term loans. The Fed exercises these powers to reduce risk in the nations banking system. Fed sets expectations for future rate increases.

As previously stated this rate influences the effective federal funds rate through open market operations or by buying and selling of government bonds government debt2 More specifically the Federal Reserve decreases liquidity by selling government bonds thereby raising the federal funds rate because banks have less liquidity to trade with other banks. During the period from June 2017 through 2018 when the Fed raised rates six times the average online savings account tracked somewhat close to the upper range of the target federal funds rate. Protecting consumer rights related to banking relationships and transactions.

Solved How Can The Fomc Use Open Market Operations To Lower Chegg Com

What Is The Federal Funds Rate The Motley Fool

Solved 2 Problems And Applications Q2 If The Fed Wants To Chegg Com

Use A Demand And Supply Graph For The Federal Funds Chegg Com

/dotdash_INV_final_The_Federal_Funds_Prime_and_LIBOR_Rates_Jan_2021-01-8010722eb0f94ecd9cbabd669c64e4e8.jpg)

The Federal Funds Prime And Libor Rates Definition

Fed Raises Rates And Projects Six More Increases In 2022 The New York Times

:max_bytes(150000):strip_icc()/fredgraph-6da2f6d034614be89a641e5e5df9ee4d.jpg)

How The Fed Funds Rate Hikes Affect The Us Dollar

Solved 29 The Discount Rate And The Federal Funds Rate The Chegg Com

The Fed Monetary Policy Monetary Policy Report

The Fed Keeps Rates Near Zero Here S How You Can Benefit

Private Enterprise Research Center The Fed And Interest Rates Where To Now

Federal Reserve Cuts Rates To Zero And Launches Massive 700 Billion Quantitative Easing Program

Fed Funds Rate Nomicsnotes From Numbernomics

The Federal Funds Rate Federal Reserve Bank Of Chicago

Solved Suppose The Federal Funds Rate Is Not Close To Zero Chegg Com

The Fed Monetary Policy Monetary Policy Report

Weekly Economic Release Summary The Federal Funds Rate Is Too Low Seeking Alpha

Comments

Post a Comment